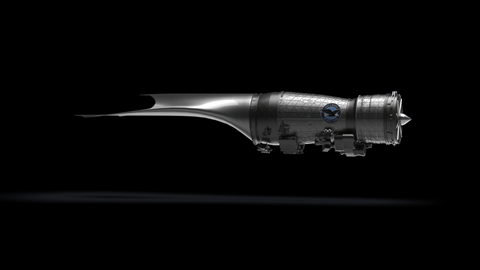

Propulsion supplier Pratt & Whitney (P&W) has begun assembling a prototype engine that could eventually power the US military’s next-generation tactical aircraft.

The RTX subsidiary is under contract with the US Air Force’s (USAF’s) Next Generation Adaptive Propulsion (NGAP) programme to deliver a so-called “adaptive” turbofan engine that could power a sixth-generation fighter.

P&W has dubbed its prototype XA103, while rival GE Aerospace has a competing engine called XA102.

In an interview with FlightGlobal, the head of P&W’s Gatorworks advanced projects unit says the engine maker in recent months began fabricating the XA103, incorporating advanced materials and fan and control systems technologies.

Chris Flynn, vice-president of military development programmes, says the new adaptive engine will provide a generational leap in performance.

“You can get range, you can get power and thermal management, you can get survivability, you get more thrust – all at the same time,” he says.

“In the past, we’ve had to prioritise [those] just because the technology wasn’t there,” he adds. “But with adaptive technology… you can get a lot of those at the same time.”

Although specifics around the NGAP powerplants remain highly restricted, the USAF has described the adaptive engine concept as providing both the aerodynamic performance of traditional low-bypass fighter engines with the efficiency of high-bypass designs.

Similar adaptive engines were built by both P&W and GE for the Lockheed Martin F-35 stealth fighter under an earlier USAF effort called the Adaptive Engine Transition Program (AETP).

While those engines were ultimately shelved by the air force in favour of upgrading the F-35’s existing P&W F135, advances developed for the AETP initiative are finding their way into successor engines as part of NGAP.

Although the technological changes are significant, Flynn says one of the most-notable improvements happening under the latest adaptive engine programme can be found in the design process.

Flynn says that for the first time in his four decades as a propulsion engineer, the design and development of a new engine is taking place entirely in a digital environment, backed by the latest modelling and simulation technologies.

“You have the real-time ability to go right into the design of the engine,” he explains. “And if you want to look at a particular feature that was a problem on another engine, you can look at it immediately, in real time.”

That helps not just P&W’s own engineers but also the company’s many suppliers who will be charged with producing the thousands of complex components that go into each engine.

Rather than sending off paper drawings, as was the case in the past, P&W can now send digital blueprints and full models of the engine and subcomponents to suppliers.

Flynn says sharing full digital models is “transforming the way we’re doing business”, allowing for rapid iteration across the design process, reducing costs and accelerating production times.

“It is probably one of the biggest changes that I have seen in my career,” he says.

But achieving those advancements is far from guaranteed.

While the USAF has committed billions of dollars to NGAP development, the project follows decades of minimal investment in military propulsion. Most Western allies’ tactical aircraft are powered by engines designed and developed during the latter part of the Cold War.

“The challenge that we have is irregular investment,” Flynn notes. “Propulsion engineers aren’t built in a day – you really need to learn the craft.”

Propulsion industry executives, including Flynn and his counterpart at GE’s Edison Works, Steve Russell, are warning that Washington risks losing its global edge in military engine technology amid industrial espionage and surging investment by the Chinese government in propulsion manufacturing.

“They are catching up,” Russell said in September. “They’re certainly trying to borrow our technology… like they have in the past.”

Flynn concurs, saying the key to maintaining the USA’s advantage is steady investment in engine technology, not just in manufacturing capacity but in the “capability to develop new things”.

“There is very little funding in new technology development,” he notes.

That contrasts with what Flynn describes as the “continual investment in propulsion” that he experienced earlier in his 40-year career.

Investment supports not only new engine designs but also improvements to existing powerplants.

“Bringing the new technologies into [existing engines] make them more capable, lower cost and can bring added capabilities,” Flynn notes, specifically mentioning range, aircraft survivability and increased power and thermal management.

P&W is currently engaged in a sweeping effort to upgrade the F135 to meet the onboard power and cooling needs of the F-35 fighter, which have grown substantially since the jet was designed.

As for the company’s XA103 NGAP engine, its future deployment remains an open matter.

The USAF has multiple next-generation combat platforms in development, including the Boeing F-47 air-superiority fighter and Northrop Grumman B-21 stealth bomber.

Either or both could eventually have NGAP engines.

Northrop is already flying two B-21 test aircraft, while Boeing is expected to fly an F-47 as soon as 2028. Meanwhile, NGAP engines are not expected to be ready before 2030 – meaning the initial crop of sixth-generation aircraft will likely fly with existing powerplants.

The US Navy is also pursuing development of its own F/A-XX sixth-generation fighter for carrier-based operations – likely with its own propulsion requirements.

Although that programme faces an uncertain future as the subject of budgetary politics in Washington, Reuters reports the Pentagon is preparing to approve a source selection for the new naval fighter.

Boeing and Northrop are finalists for the competitive programme, after Lockheed was eliminated by the navy earlier this year.