Chicago-based carrier reports improved booking trends and business demand acceleration despite Newark operational challenges, revising full-year earnings forecast

Travel disruptions earlier this year at Newark Liberty International airport cost United Airlines $218 million in the second quarter, and the airline expects the fallout will also damper its third-quarter results.

United, however, says Newark bookings are now close to normal and that travel demand broadly picked up in the first half of July, a trend it reads as indicating that tariff-induced economic uncertainty has eased.

“United has seen a sequential six point acceleration in demand, and a double-digital acceleration in business demand, versus the second quarter,” the Chicago company said on 16 July when releasing its second-quarter financial results. “The airline attributes this to less geopolitical and macroeconomic uncertainty”.

That assessment comes one week after competitor Delta Air Lines likewise reported an outlook that is rosier than might have been expected considering concerns about President Donald Trump’s recent tariffs.

United turned a $973 million profit in the second-quarter, down 26% year on year.

Its second-quarter pre-tax profit margin came in at 8.2%. That figure would have been 1.2 points greater if not for widespread delays and cancellations earlier this year at Newark. Those disruptions, caused by air traffic congestion and air traffic control (ATC) equipment failures, “drove customer bookaway”, United says.

Airlines, working with the DOT, responded by trimming Newark flights. United says its Newark operation has since improved and that “booking volumes” for Newark flights have “normalised”. Still, United expects Newark’s troubles will leave its third-quarter adjusted profit margin nearly one percentage point less than it otherwise would have been.

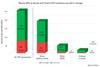

At the start of 2025, United had predicted that its full-year adjusted earnings would be 11.50-13.50 per share. Then on 15 April, amid the height of stock market uncertainty caused by Trump’s tariffs, United warned that in the case of recession it’s earnings would likely come in at $7-9 per share.

On 16 July, United revised its forecast again, hitting a middle ground. It now expects full-year adjusted earnings per share of $9-11 per share.